Price elasticity of demand measures the responsiveness of demand to changes in the commodity’s own price. It represents the ratio of the relative change in a dependent variable (quantity demanded) to the relative change in an independent variable (Price). Thus, price elasticity is the ratio of a relative change in quantity demanded to a relative change in price. Let ‘e’ stand for elasticity. Then

ep = relative change in quantity demanded / relative change

in price

ep = percentage change in quantity demanded / relative change in price

If percentages are known, the numerical value of elasticity can be

calculated. The coefficient of elasticity of demand is a pure number i.e. it

stands by itself, being independent of units of measurement.

The coefficient of price elasticity of demand can be calculated with the help of the following formula.

The coefficient of price elasticity of demand can be calculated with the help of the following formula.

ep= ∆Q/Q . P/ ∆P

where, Q is quantity,

P is price,

DQ/Q relative change in the quantity demanded,

P/∆P Relative change in price.

A minus sign (-) is generally inserted in the formula before the fraction with a view to making the coefficient of elasticity a non-negative value.

The price elasticity can be measured between two finite points on a demand curve (called arc elasticity) or on a point (called point elasticity).

where, Q is quantity,

P is price,

DQ/Q relative change in the quantity demanded,

P/∆P Relative change in price.

A minus sign (-) is generally inserted in the formula before the fraction with a view to making the coefficient of elasticity a non-negative value.

The price elasticity can be measured between two finite points on a demand curve (called arc elasticity) or on a point (called point elasticity).

Arc Elasticity:

ep= ∆Q/Q . P/ ∆P

- Two finite points on a demand curve make an arc.

- Arc elasticity is the average responsiveness to price changes shown by a demand curve over some definite stretch of the curve.

- The measurement of elasticity of demand between any two finite points on a demand curve is known as arc elasticity.

ep= ∆Q/Q . P/ ∆P

For example, in the above Fig, two finite points R and S are taken

to measure the arc elasticity. First we move to measure elasticity for a fall

in the price of the commodity from Rs.40 to 20. DP is 40-20 = 20. This

decrease in price causes an increase in demand from 40 units to 70 so that DQ is 40-70 = -30. These values can be put in the formula so that

ep=-30/20. 20/20

This implies that a one percent fall in price of commodity X cause a 1.5 per cent increase in demand for X.

ep=-30/20. 20/20

This implies that a one percent fall in price of commodity X cause a 1.5 per cent increase in demand for X.

- The business executives need take adequate care in the measurement, interpretation and use of arc elasticity, as the elasticity coefficient may vary depending upon the direction of movement.

- In this case we have measured the elasticity coefficient while moving down from point R to S.

- The coefficient will be different while moving upward from S to R (increase in price from Rs.20 to 40 and quantity demanded is reduced from 70 to 40 giving an elasticity coefficient of .42 implying that one per cent increase in price will reduce the quantity by.42 percent.

- Thus the elasticity depends on the direction of change in price. Therefore, measuring elasticity through arc method, the direction of price change should be kept in mind. The way out of this difficulty is to take an average of prices and quantities and thus to measure elasticity at the midpoint of the arc.

Point elasticity of demand is defined as the proportionate change in the quantity demanded resulting from a very small proportionate change in price. Fig. shows how to find the elasticity at a point on a demand curve.

Let us take a point such as R on the demand

curve DD. For measuring elasticity at a point the following formula may be

used. ep= ∆Q/Q . P/ ∆P. Point elasticity

is the product of price-quantity ratio (P/Q) at a particular point (R) on the

demand curve (DD) and the reciprocal of the slope of the demand line. The slope

of the demand slope is defined by RQ/QD. The reciprocal of the slope of the

demand line is QD/RQ.

P = Q/ P =

QD/RQ

At point R, price P = RQ and Q = OQ

At point R, price P = RQ and Q = OQ

If we substitute

these values in equation 3.11, what we get is = RQ/OQ. QD/RQ = QD/OQ If the numerical

values for QD and OQ are available, elasticity at point R can be calculated.

Price elasticity at Different Points on a Non-Linear Demand Curve:

The method used to measure point elasticity on a linear demand curve cannot be applied straightway to measure point elasticity on a non-linear demand curve.

In order to measure point elasticity on a non-linear demand curve, we first draw a tangent to the selected point and bring it on a linear demand curve.

Fig illustrates how we can measure point elasticity on a non-linear demand curve at point R. For this purpose, we draw a tangent TT’ through point R. Since demand curve DD and the line TT’ pass through the same point R, the slope of the demand curve and that of the tangent is the same. Therefore, the elasticity of demand curve at point R will be the same as the elasticity on point R on line TT’. The formula applied to measure the elasticity on a linear demand curve can now be used as the non-linear demand curve has been changed into a linear demand curve.

Price elasticity at Different Points on a Non-Linear Demand Curve:

The method used to measure point elasticity on a linear demand curve cannot be applied straightway to measure point elasticity on a non-linear demand curve.

In order to measure point elasticity on a non-linear demand curve, we first draw a tangent to the selected point and bring it on a linear demand curve.

Fig illustrates how we can measure point elasticity on a non-linear demand curve at point R. For this purpose, we draw a tangent TT’ through point R. Since demand curve DD and the line TT’ pass through the same point R, the slope of the demand curve and that of the tangent is the same. Therefore, the elasticity of demand curve at point R will be the same as the elasticity on point R on line TT’. The formula applied to measure the elasticity on a linear demand curve can now be used as the non-linear demand curve has been changed into a linear demand curve.

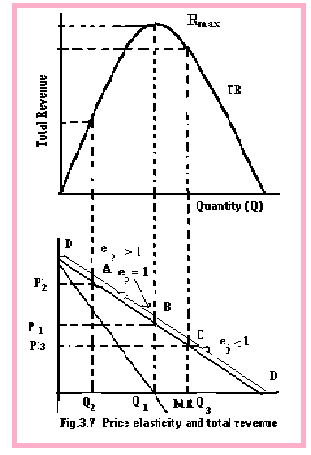

PRICE ELASTICITY AND TOTAL REVENUE

One important application of elasticity is to clarify whether a

price increase will raise or lower total revenue. Many business executives are

concerned with the issue whether it is worthwhile to raise prices and whether

the higher prices make up for lower demand. Total revenue is

equal to price times quantity (TR = P.Q). If we know the price elasticity of

demand, we may know what will happen to total revenue when price changes:

MR = Δ (TR)/ ΔQ = Δ (PQ)/ΔQ MR = P + Q.ΔP/DQ

If the demand curve is linear its equation is

Q = b0 – b1 P.

Solving for P, P = a0 - a1Q.

Where a0 = b0/b1, And a1 = 1/b1.

Substituting P in the total revenue function we find.

TR = PQ = a0Q -a1Q2

The MR is the MR = Δ (TR)/ΔQ = a0 – 2a1Q Figure shows that if the demand curve is falling the TR curve initially increases, reaches a maximum, and then commences declining.

The relationship between MR, P and e can be used to establish the shape of the total-revenue curve.

- If price elasticity (ep > 1), reducing the price will increase the total revenue.

- When demand is perfectly inelastic ep = 0, there is no decrease in quantity demanded when price is raised. Therefore, a rise in price increases the total revenue and vice versa.

- In case of an inelastic demand (e p < 1), the total revenue falls when the price is decreased. The total revenue increases when the price is increased.

- When the demand for a product is unitary elastic (ep = 1) quantity demanded increases or decreases in the proportion of increases or decrease in the price.

MR = Δ (TR)/ ΔQ = Δ (PQ)/ΔQ MR = P + Q.ΔP/DQ

If the demand curve is linear its equation is

Q = b0 – b1 P.

Solving for P, P = a0 - a1Q.

Where a0 = b0/b1, And a1 = 1/b1.

Substituting P in the total revenue function we find.

TR = PQ = a0Q -a1Q2

The MR is the MR = Δ (TR)/ΔQ = a0 – 2a1Q Figure shows that if the demand curve is falling the TR curve initially increases, reaches a maximum, and then commences declining.

The relationship between MR, P and e can be used to establish the shape of the total-revenue curve.

The total

revenue curve reaches its maximum level at the point where ep = 1,

because at this point its slope, the marginal revenue, is equal to zero

MR = P (1 – 1/1) = 0

If ep > 1 the

total revenue curve has a positive slope. It is still increasing and has not

reached its maximum point. If ep <1 the total-revenue has a negative slope and is falling.

The following can be summarized:

- If the e p < 1), the demand is inelastic. A rise in price causes an increase in total revenue, and a decrease in price leads to a fall in total revenue.

- If e p > 1, the demand is elastic, and increase in price will cause a decrease in the total revenue and a decrease in price will lead to an increase in the total revenue.

- If e p = 1, the demand is unitary elastic, total revenue is not affected by changes in price because MR has reached zero.

Price Elasticity and Marginal Revenue

Demand and marginal revenue curves show where demand is elastic,

unitary elastic and inelastic. It is clear that demand becomes less elastic at

lower prices. This is a characteristic of linear demand curves because the

curve is linear dQ/dP is a constant. Thus price elasticity is determined by the

value of P/Q. But as price decreases, P/Q also decreases

Consequently, the absolute value of ep

becomes smaller and demand becomes less elastic.

The above figure illustrates that the point of unitary elasticity corresponds to the point where the marginal revenue crosses the quantity axis.

- The marginal revenue is zero where demand is unitary elastic.

- Unitary elasticity means that a 1 percent increase in price causes quantity demanded to decrease by 1 percent and the increase in price is exactly offset by the decrease in quantity demanded. Consequently, there is no change in total revenue as the marginal revenue is zero.

- The marginal revenue is positive where demand is elastic and negative when demand is inelastic. Note that these relationships are also true for nonlinear demand curves. The point where marginal revenue is zero always divides the elastic and inelastic regions of the demand curve.

In case of a

vertical demand curve, quantity demanded is not affected by changes in price as

dQ/dP is zero and price-elasticity is also zero. For a horizontal demand curve,

quantity demanded is highly responsive to changes in price as even a very small

change in price can lead to an infinitely large change in quantity demanded as

dQ/dP and price elasticity being infinite. Horizontal demand curves are said to

be infinitely elastic. The cases of infinitely elastic or completely inelastic

demand curves are rare to find in real life, but an understanding of these is

useful for economic analysis.

No comments:

Post a Comment